The Single Strategy To Use For Broker Mortgage Rates

Wiki Article

Mortgage Broker Average Salary Things To Know Before You Buy

Table of ContentsGetting My Mortgage Brokerage To WorkThe 2-Minute Rule for Mortgage Broker AssistantThe smart Trick of Mortgage Broker That Nobody is DiscussingAn Unbiased View of Broker Mortgage RatesSome Known Questions About Mortgage Broker Association.Fascination About Mortgage Broker Assistant Job DescriptionThe Facts About Mortgage Broker Meaning UncoveredAll About Mortgage Broker Assistant

What Is a Home mortgage Broker? A home loan broker is an intermediary between an economic establishment that uses fundings that are protected with property and also people interested in purchasing realty that require to obtain money in the type of a car loan to do so. The home loan broker will certainly deal with both parties to obtain the individual authorized for the financing.A home loan broker typically functions with various lenders as well as can provide a variety of loan choices to the debtor they collaborate with. What Does a Home loan Broker Do? A home mortgage broker intends to finish actual estate purchases as a third-party intermediary between a consumer and a lender. The broker will accumulate info from the private and also most likely to numerous lending institutions in order to find the very best potential lending for their customer.

The Basic Principles Of Mortgage Brokerage

All-time Low Line: Do I Need A Mortgage Broker? Collaborating with a mortgage broker can conserve the customer effort and time throughout the application process, and also possibly a whole lot of money over the life of the loan. Additionally, some lending institutions work solely with home loan brokers, meaning that borrowers would certainly have accessibility to financings that would certainly otherwise not be offered to them.It's essential to check out all the charges, both those you might have to pay the broker, in addition to any costs the broker can aid you prevent, when considering the choice to collaborate with a mortgage broker.

Mortgage Brokerage for Beginners

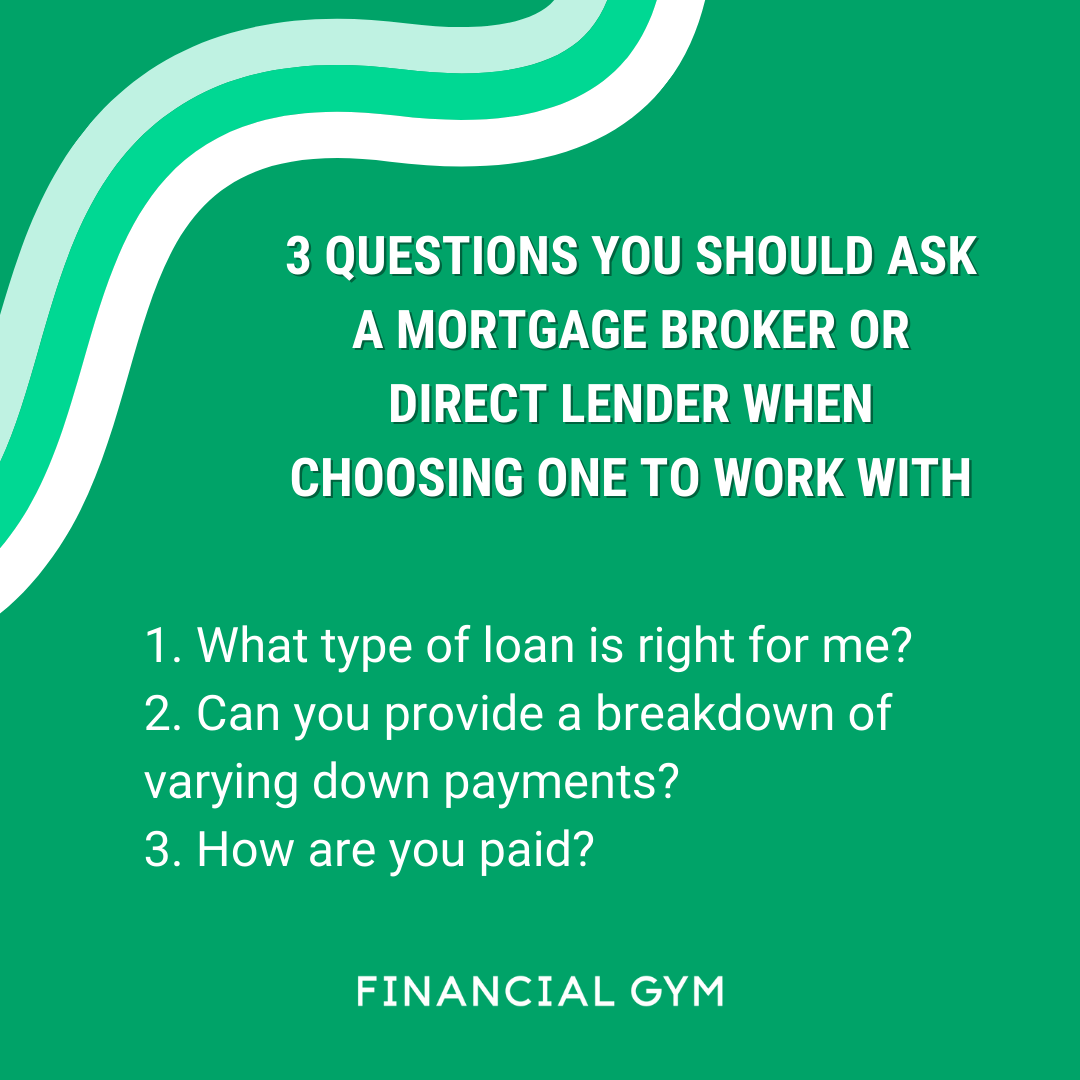

You have actually possibly listened to the term "mortgage broker" from your realty agent or friends who've purchased a house. What exactly is a home loan broker as well as what does one do that's various from, claim, a finance officer at a bank? Geek, Purse Guide to COVID-19Get solution to questions about your home loan, travel, financial resources and keeping your satisfaction.1. What is a home loan broker? A home mortgage broker acts as a middleman between you and potential lending institutions. The broker's job is to compare home mortgage loan providers on your part and locate rate of interest that fit your requirements - mortgage broker job description. Mortgage brokers have stables of lending institutions they function with, which can make your life less complicated.

All About Mortgage Broker Vs Loan Officer

Just how does a home mortgage broker obtain paid? Home loan brokers are most frequently paid by lenders, sometimes by consumers, yet, by law, never ever both.The competitiveness and also house costs in your market will contribute to determining what home mortgage brokers cost. Federal law restricts how high compensation can go. 3. What makes home mortgage brokers different from funding policemans? Funding officers are staff members of one loan provider that are paid set salaries (plus perks). Financing policemans can compose only the kinds of finances their company selects to supply.

9 Easy Facts About Mortgage Brokerage Described

Mortgage brokers may have the ability to provide customers access to a wide option of lending kinds. 4. Is a home loan broker right for me? You can conserve time by using a home mortgage broker; it can take hrs to make an application for preapproval with different lending institutions, after that there's the back-and-forth communication associated with financing the lending as well as ensuring the transaction remains on track.When selecting any type of lending institution whether with a broker or directly you'll want to pay attention to lender charges. Particularly, ask what costs will certainly show up on Page 2 of your Car loan Quote type in the i loved this Funding Costs area under "A: Source Charges." After that, take the Car loan Quote you best site obtain from each loan provider, position them side by side and compare your passion rate as well as all of the charges and also closing expenses.

Some Known Facts About Mortgage Broker Meaning.

Just how do I choose a mortgage broker? The ideal way is to ask good friends and relatives for references, however make certain they have in fact used the broker and also aren't just dropping the name of a previous college flatmate or a distant acquaintance.

Top Guidelines Of Mortgage Broker Assistant

Competitors as well as residence costs will certainly influence just how much home loan brokers obtain paid. What's the difference in between a mortgage broker and also a finance police officer? Finance officers work for one lender.

Some Known Incorrect Statements About Broker Mortgage Meaning

Getting a brand-new house go to this web-site is among the most intricate occasions in a person's life. Characteristic vary substantially in terms of design, features, institution area and also, obviously, the constantly crucial "location, location, location." The home mortgage application procedure is a challenging element of the homebuying procedure, specifically for those without previous experience.

Can determine which problems could produce difficulties with one lender versus another. Why some purchasers avoid mortgage brokers Often property buyers really feel extra comfy going straight to a big financial institution to secure their car loan. Because situation, customers must a minimum of talk with a broker in order to recognize all of their alternatives concerning the sort of lending and also the offered rate.

Report this wiki page